Apple unveils a new AI model in Apple Watch that detects hidden health conditions like pregnancy, infections, and heart issues with 92% accuracy.

Samsung unveils Galaxy Z Fold 7, Flip 7, and Watch 8 at Unpacked 2025 with AI upgrades, sleek designs, powerful specs, and global release dates.

Ford issues a 2025 recall of 850,000+ vehicles due to fuel pump defects that may cause engine stalling. See affected models and repair details.

Discover the emotional and humorous post-credit scenes in Superman 2025.

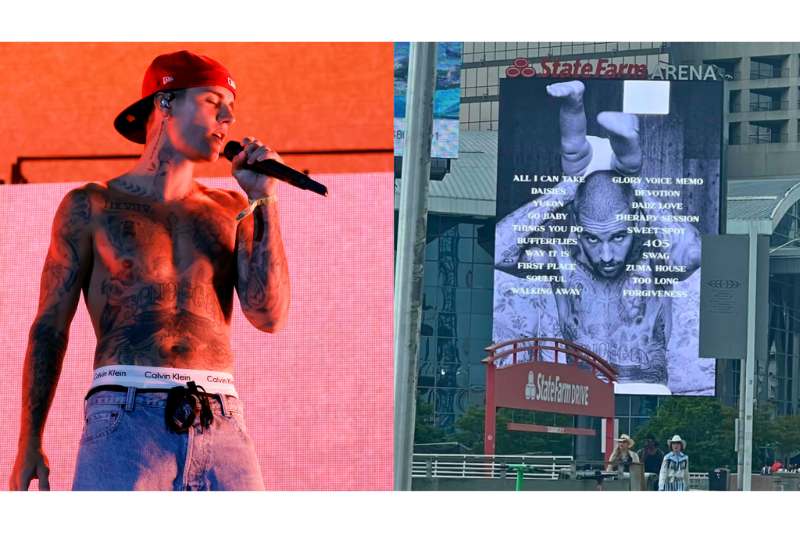

Justin Bieber releases his surprise album 'SWAG' featuring 21 tracks with Gunna, Sexyy Red, Dijon, and more. See the full tracklist and production credits.

A 70-million-year-old dinosaur fossil was discovered 763 feet under the Denver Museum of Nature & Science parking lot during a geothermal drill, marking the oldest fossil found in the Denver Basin.

UFC fighter Ben Askren shares a shocking health update after a double lung transplant. He flatlined four times, lost 50 pounds, and is now recovering.

Linda Yaccarino resigns as CEO of X following AI controversy and leadership challenges. Discover what led to her sudden exit and what's next for the platform.

Nvidia becomes the first company to cross a $4 trillion market cap. Learn how this milestone impacts NVDA stock price, future valuation, and AI growth outlook.

Earth recorded its shortest day on July 9, 2025, spinning faster than ever before. Scientists now consider a rare negative leap second by 2029.